Higher figures indicate that a company pays its bills on a more timely basis, and thereby has less debt on the books. Increasing Accounts Payable Turnover RatioĬreditors and investors will look at the accounts payable turnover ratio on a company’s balance sheet to determine whether the business is in good standing with its creditors and suppliers. That means the company has paid its average accounts payable balance 6.25 times during that time period. Say that in a one-year time period, your company has made $25 million in purchases and finishes the year with an open accounts payable balance of $4 million. Use this formula to convert AP payable turnover to days.Īccounts Payable Turnover Ratio in Days = 365 / Payable turnover ratio Accounts Payable (AR) Turnover Ratio Example Dividing that average number by 365 yields the accounts payable turnover ratio.Īverage number of days / 365 = Accounts Payable Turnover Ratio Breaking Accounts Payable Turnover into Days Accounts Payable (AP) Turnover Ratio Formula & CalculationĪccounts payable turnover rates are typically calculated by measuring the average number of days that an amount due to a creditor remains unpaid. If you utilize a year's worth of expenses from sales, you should also use the accounts payable from the start and end of the same year. For instance, if the AP turnover ratio is 5, it signifies that the company has settled its debts to its suppliers 5 times throughout the duration of the period.Įnsure consistency in periods for this calculation. The figure you obtain represents the frequency with which the company has settled its typical payable amount within the specified period.

Once you have these values, divide the total expenses from sales (or total acquisitions) by the average accounts payable to get the AP Turnover Ratio. These data points can be sourced from the company's balance sheet. The calculation is as follows: (Accounts Payable at Start of Period + Accounts Payable at End of Period) / 2.

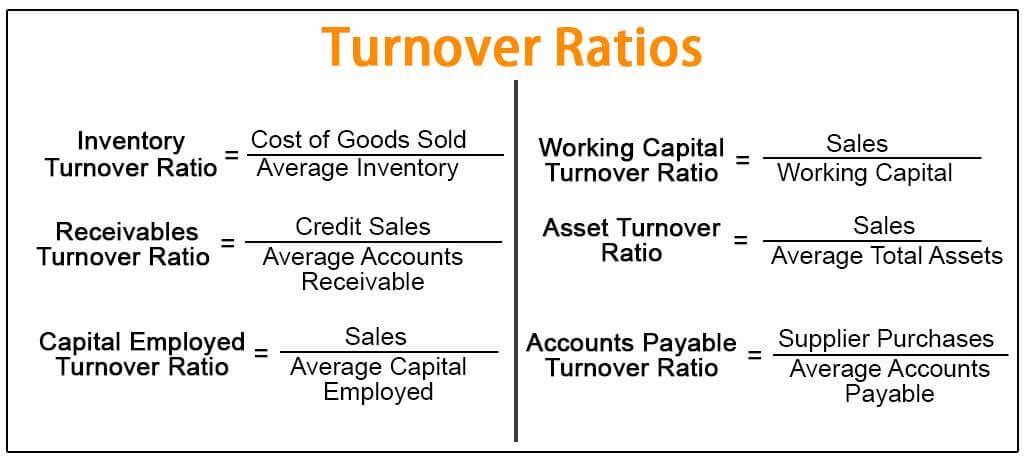

Total Cost of Sales (or Total Purchases): This value represents the aggregate expense for goods sold over a specific timeframe.The AP Turnover Ratio measures the frequency with which a business settles its debts to suppliers within a defined timeframe.

#INVENTORY TURNOVER FORMULA DAYS HOW TO#

How to Calculate Accounts Payable (AP) Turnover RatioĪccounting professionals calculate accounts payable turnover ratios by dividing a business’ total purchases by its average accounts payable balance during the same period.

Low AP ratios could signal that a company is struggling to pay its bills, but that is not always the case.A higher accounts payable ratio indicates that a company pays its bills in a shorter amount of time than those with a lower ratio.On a company’s balance sheet, the accounts payable turnover ratio is a key indicator of its liquidity and how it is managing cash flow. Accounting professionals quantify the ratio by calculating the average number of times the company pays its AP balances during a specified time period. The accounts payable turnover ratio measures how quickly a business makes payments to creditors and suppliers that extend lines of credit. What Is Accounts Payable (AP) Turnover Ratio? This is a critical metric to track because if a company’s accounts payable turnover ratio declines from one accounting period to another, it could signal trouble and result in lower lines of credit.Ĭonversely, funders and creditors seeing a steady or rising AP ratio may increase the company’s line of credit. East, Nordics and Other Regions (opens in new tab)Ī high accounts payable ratio signals that a company is paying its creditors and suppliers quickly, while a low ratio suggests the business is slower in paying its bills.

0 kommentar(er)

0 kommentar(er)